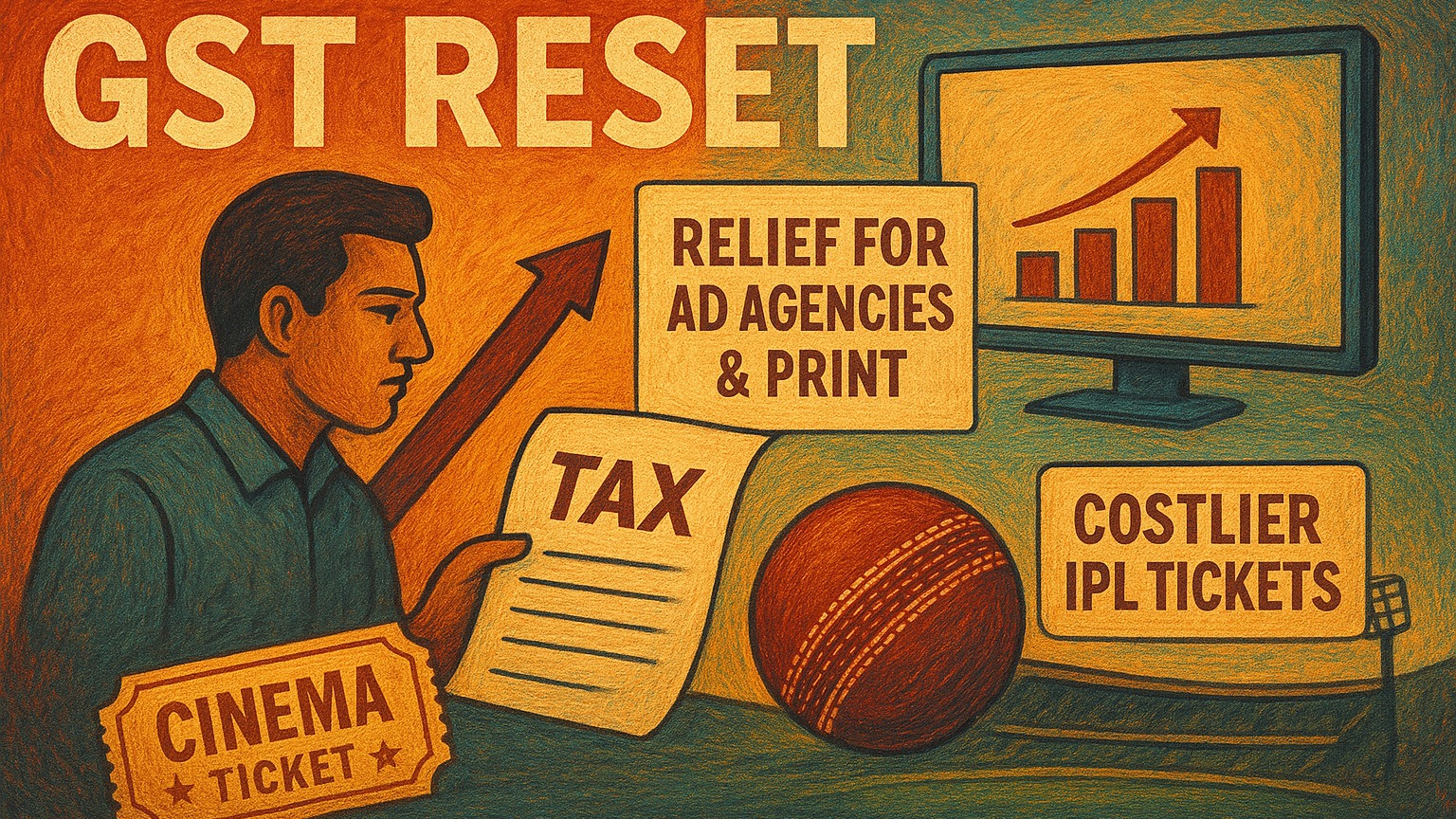

GST Reset: Relief for ad agencies & print; Costlier IPL tickets – Implications for India’s M&E economy – Adgully.com

India’s Media & Entertainment (M&E) sector – spanning advertising, film, OTT, gaming, live events, and publishing – is staring at a sweeping recalibration of costs and margins under the latest Goods & Services Tax (GST) revisions. As per an analysis by EY, titled ‘GST 2.0 – Media & Entertainment’, while some categories are set to gain relief through rate cuts, others – particularly online gaming and live entertainment – face a steeper tax burden that could alter consumption patterns, business models, and pricing strategies across the board.

Advertising & Exports: Relief on the Horizon

A key structural change lies in the treatment of intermediary services. The ‘location of service provider’ (agencies, facilitators, and intermediaries) has been redefined as ‘location of the service recipient’. This effectively zero-rates GST on such exports, down from 18%, making Indian advertising and media agencies more competitive globally. Industry insiders see this as a long-awaited correction that could boost service exports.

Cinemas & Exhibition: A Small Win for the Mass Market

The GST on cinema tickets priced at ₹100 or less has been cut from 12% to 5%, offering some respite to exhibitors battling post-pandemic recovery. While the relief is targeted at lower-ticket mass audiences, multiplexes argue that high-ticket slabs remain untouched, limiting overall sectoral impact.

Food & Beverages: Margins in Flux

Given that F&B sales are a critical revenue stream for cinemas, live events, and multiplexes, the rate rejig is consequential. Items such as juices, namkeen, milk beverages, chocolates, and pastries see cuts from 18%/ 28%/ 40% to 5%/ 18%/ 40%, while non-alcoholic beverages face increases. With Input Tax Credit (ITC) restrictions on F&B largely intact, operators will need to rethink pricing strategies to balance margins and consumer affordability.

Events & Live Entertainment: A Heavy Hit

Admission to casinos, race clubs, and sporting events like the IPL will now attract 40% GST (up from 28%), with ITC. This steep hike is expected to significantly raise ticket prices, potentially dampening demand. However, ambiguity around whether all large-scale sporting events are covered continues to cloud industry sentiment. By contrast, cultural and performing arts – from classical dance to theatre and planetariums – remain at 18%.

Broadcasting & Home Entertainment: Hardware Gets Cheaper

Consumer electronics feeding the content economy – TVs, monitors, projectors, and air conditioners – see a drop in GST from 28% to 18%. The move eases ITC accumulation for broadcasters and OTT players and could lower entry barriers for consumers upgrading home entertainment systems, indirectly supporting viewership growth.

Online Gaming & Betting: A Sharper Squeeze

Online money gaming, betting, and gambling face a 40% GST slab (up from 28%). With platforms already under pressure from regulatory scrutiny, this hike is expected to force a reset in pricing, payouts, and customer acquisition economics. Analysts caution that higher taxes could accelerate consolidation or push consumers toward offshore, unregulated platforms.

Publishing & Print: Structural Cost Relief

Printing services and job work attract 5% GST (down from 12%), while paper and stationery also move from 12% to 5% or nil. This translates to lower input costs for newspapers, magazines, and publishers – a sector battling declining ad revenues and rising costs. The reduction could ease financial strain, especially for regional and vernacular publishers.

Content Production: Lower Costs for Shoots, Higher Efficiency

GST on beauty, fitness, and wellness services has dropped from 18% with ITC to 5% without ITC, lowering costs for shoots, events, and celebrity management. Similarly, hotel accommodation under ₹7,500 per night falls from 12% with ITC to 5% without ITC, providing relief to production houses and event organisers managing large crews.

The GST rejig is far from uniform in its impact. Export-oriented ad agencies, publishing houses, and content producers emerge as winners, with costs set to ease. Conversely, online gaming and live sporting events face severe cost escalation, threatening demand elasticity. For cinema, multiplex, and F&B, the outcome is mixed – some relief at the lower end, but margins remain pressured at the premium level.

Ultimately, the changes signal a sharper policy tilt between revenue maximisation and sectoral support, leaving India’s M&E industry to recalibrate strategies in a landscape where taxation could be as disruptive as technology.

similar newsDabang Delhi KC unveils strong sponsor line-up for PKL season 12

similar newsJioHotstar’s campaign for The Paper proves print still makes news

similar newsJiostar sweeps GEMA India awards with 32 metals – 15 golds and 17 silvers across categories

similar newsSony Sports Network all set to broadcast Asia Cup 2025 with multilingual coverage and star-studded expert panel

similar newsNDTV Profit’s GST Conclave 2025: FM to unveil roadmap for GST 2.0

similar newsTelegraph Editor Sankarshan Thakur Passes Away at 63

similar newsZ partners with MP Tourism Board to boost state tourism with digital-first push

similar newsManiesh Paul shares BTS of Bijuriya song from Sunny Sankari Ki Tulsi Kumari

A post shared by Maniesh Paul (@manieshpaul)

similar newsManiesh Paul shares BTS of Bijuriya song from Sunny Sankari Ki Tulsi Kumari

similar newsIndia Today Group’s MO Launches Secret Lives of Teenagers Podcast with Swiggy as Presenting Partner

similar newsInspire institute of sport launches ‘IIS Sikhaega’

Share this content:

Post Comment